Bank of America announced some pretty big changes that will make their customers happy.

On Tuesday, the bank announced plans to end its $35 fee for non-sufficient funds in February.

Non-sufficient fund fees occur when a payment bounces.

In May, the bank will decrease its $35 overdraft fee to $10.

Overdraft fees occur when consumers withdraw more than the agreed amount.

Bank of America is joining banks like Allied and Capital One, which started reducing their fees earlier last year.

Holly O’Neill, Bank of America’s president of retail banking, said in a statement:

Over the last decade, we have made significant changes to our overdraft services and solutions, reducing clients’ reliance on overdraft, and providing resources to help clients manage their deposit accounts and overall finances responsibly.

Wells Fargo announced its plan to end non-sufficient fund fees by the end of the first quarter.

They also plan to end transfer fees for accounts enrolled in overdraft protection.

It was consumer advocacy groups, who applied pressure to Bank of America to lower their overdraft fees.

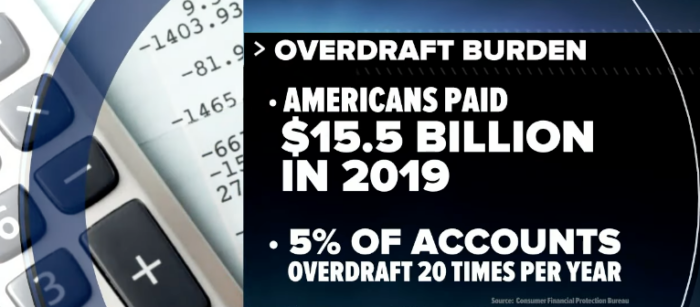

Research shows Americans paid $15.5 billion in bank fees in 2019

In most cases, the fees are being paid by those who are financially strapped.

Watch the GMA report below:

As a Bank of America member, this is great news.

Source: MarketWatch